CMAs (Comparative Market Analysis) are used daily in real estate – here is an explanation of how they are prepared, from what data and how they are helpful in determining what your home is worth.

My colleagues and I recorded a video discussing CMAs, how they’re prepared and how they are used. In this video, Rich Cederberg, Jeff Dowler, Bryan Robertson and I discuss how CMAs differ from appraisals and how they are an effective tool is determining how much your home is worth!

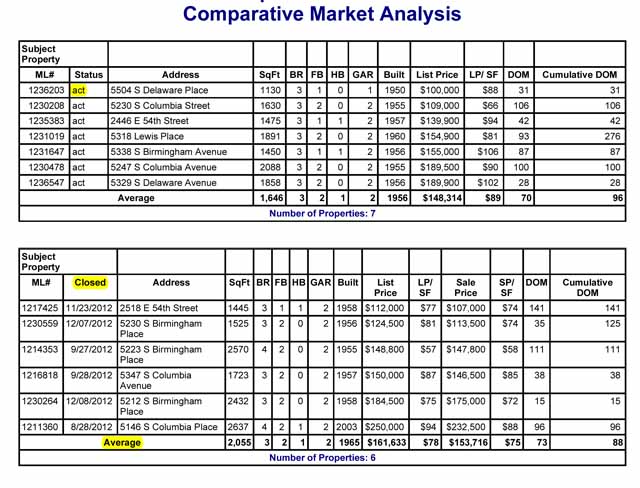

A CMA is a collection and interpretation of data from our MLS (Multiple Listing Service) of comparable home sales – used to estimate the value of a property. It is a reflection of a snapshot in time of current inventory and historical data of homes sold. Typically we review six months of historical data, but that varies.

We look at ACTIVE properties for sale to evaluate our competition – those home Sellers are still looking for Buyers. We look at SOLD properties to see what the market will actually pay. If the average sold price per square foot in a particular neighborhood is $90/square foot, and there are two properties that sold for $100/square foot, we’ll want to know what was special about those two properties. The Tulsa MLS just recently (2017) added Seller concessions – amounts the Seller may have paid towards the Buyer’s closing costs (this may vary by state associations). Often the sales price is increased to offset Seller concessions, and this skews our data to some extent.

A CMA is not an appraisal and not an exact science. Because real estate is seasonal, a CMA prepared in October will include homes sold during the popular spring and summer months, while one prepared in April will include homes sold over the winter months.

CMAs are also used to estimate a neighborhood’s absorption rate analysis. If 36 homes sold in your subdivision in the past twelve months, we can assume that three homes are selling per month. If there are 12 homes for sale currently, that would be equivalent to a 4-month inventory or supply. When you are pricing your home for sale, you need to determine if you want to be the next house sold or if you are willing to stay on the market for 2-3 months.

CMAs are used by Sellers to help them determine a list price for their home and they are used by Buyers to determine what to offer on a home. Because we may not have been inside many of these homes, we are often dependent upon descriptive text provided by the Realtor to select appropriate comps. If the home you are selling has granite counter-tops, updated baths and quality wood flooring, we are not going to compare your home to one that needs TLC (tender loving care) or one that has laminate counter tops.

CMA Explained – Comparative Market Analysis – How Much is my Home Worth?

CMAs are a tool – and nothing more. If you price your home for sale at $300,000 and then two more homes come on the market two weeks after you list, you may need to react with a price adjustment.

We want your CMA to reflect the same data that an Appraiser may use. If your Buyer is financing his or her purchase, the bank will only lend the value the Appraiser determines. So, it’s important to follow the same guidelines used by Appraisers when preparing your CMA. General guidelines are to stay as close to the subject property as possible, but within a mile (numerous exceptions); stay within plus or minus 15% of your square footage; compare to properties sold within the past six months.

If you would like to know what YOUR home is worth, please visit my web site or call me today! 918-852-5036

Content written and published by Lori Cain.

Excellent post explaining exactly what a CMA is and how it helps home sellers set a price when they put their homes on the market. I especially like the fact that you’ve written it in such a way that it’s easy to understand – It’s a somewhat complicated subject and that’s not easy to do!

Why thank you Denise! Feel free to share with your Sellers!