No Tulsa home buyer wants to hear from their Lender that their home loan has been denied. Yet, it still happens. Here’s what you can do to prevent the devastating emotional and financial loss of a loan denial.

Speak to a Lender BEFORE you begin house shopping and GET ALL OF YOUR DOCUMENTATION TURNED IN to your Lender. Yes, Lenders will give you a pre-qualification letter based on your stated income, time on the job, and credit score. It’s when the Underwriters start evaluating your documentation that the level of scrutiny increases and the factors that can disqualify you are discovered.

The Underwriters will evaluate all of your assets and financial transactions. Every deposit and expense can be questioned. If you work a “regular job” and are paid hourly or are salaried, your loan should be fairly cut and dry. Unless you have outstanding debts, unpaid medical bills, or student loans, your Underwriting process should go fairly quickly. However, if you are self-employed or have any type of sporadic income, get ready for your financial life to be dissected and reviewed under a microscope.

Some of the more common reasons why a loan will be denied include (1) poor credit history; (2) small down payment; (3) issues with the property such as structural problems; (4) insufficient income and asset documentation; and (5) inadequate employment history or change of employment.

Suppose the Underwriter discovers that you have negative items on your credit report or discovers an outstanding unpaid medical bill? What if the loan requirements or lender guidelines change during your Underwriting process?

The main reason for getting pre-approved for a mortgage before you begin shopping for houses is to make certain you are shopping in a price range you can afford. It’s no fun looking at $300,000 homes only to find out that you can’t spend over $250,000. You may have already fallen in love with homes that have amenities you can’t afford. Also, when presenting your offer, if you can provide a letter from your Lender that states that your documentation has already been reviewed and you have gone through the first stages of Underwriting, this makes your offer stronger. When inventory is low and homes are selling quickly, being a “strong buyer” is a huge advantage.

While these guidelines are constantly evolving, currently a buyer is required to have solid employment for a period of two years. If there are gaps in employment, the Underwriter is going to require an explanation. Underwriters assess your ability to repay the loan, so inconsistent income is going to be a red flag.

Maintain a good credit score and understand how that score is formulated. A free and fairly accurate website where you can track your score is Credit Karma. It even has a credit score simulator, so you can see how much your score will increase if you reduce a credit card debt, for example.

While you are in Underwriting, continue to pay your bills on time and DO NOT incur new debt. In other words, please do not purchase a new car or new furniture a week before you are supposed to close on your home – big triggers for loan denial.

One of the most critical factors in your loan qualification is a debt-to-income ratio – and generally, the allowable threshold is 43%. If your debts total $2,000 per month and your income is $6,000 per month, that puts your debt-to-income ratio at 33%. If you increase your debt to $3,000 per month, that puts your debt-to-income ratio at 50%, which is unacceptable and may result in loan denial. Further, a standard rule for Lenders is that your monthly housing debt (principal, interest, taxes, and homeowner’s insurance) should be 28% of your income before taxes.

What is out of your control is when the actual loan requirements change or Lender guidelines change. It is possible that the amount of reserves (savings) that the Lender requires may increase or there may be a change to the debt-to-income guidelines.

The sooner you know where you stand, the better prepared you can be to react to these unforeseen changes.

Now, what if there is an issue with the Appraisal? The most common issue is when the Appraiser values the property for less than the contract sales price. In that case, generally, the Seller reduces the price to equal the amount for which the property was appraised. But the Appraiser may also have “requirements” such as painting an area with chipped paint or installing a handrail. While these repairs may not be important to the Buyer or the Seller, if it is a requirement of the Appraiser, the repairs must be completed prior to closing. The property itself is the collateral for the loan, so understandably, the Lender wants to ensure that the house is healthy and safe.

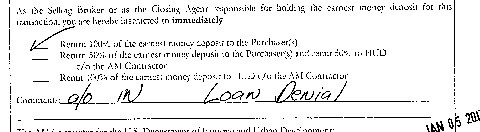

At this point, the Buyer has spent money on inspections, an appraisal and earnest money. So a loan denial is devastating for all involved – be prepared so this doesn’t happen to you.

If you are unsure of which Lender to call, please consider those on my Preferred Vendor List. And if you are pre-qualified or pre-approved and ready to shop for a home in midtown Tulsa, please do give me a call! 918-852-5036

Content written and published by Lori Cain.