Appraisals – it’s not just about comparables any more

New one for me today. Transaction going along swimmingly until notification today that our appraisal was pulled and reviewed during the appraisal review process. Our $110,000 property is assumed to be worth only $90,000. And we’re scheduled to close in less than 48 hours.

The property appraised for sales price; however the reviewer complained that the Appraiser did not pull one EXACT comparable. This home is a two bedroom, one bath, one-car garage home, and every comparable the Appraiser used was at least three bedrooms.

So, Lender calls me and asks me to find better comps, which is not my job – I represent the Buyer. But, I sit down at my computer and follow the guidelines in search for an exact comp.

Guidelines are, by the way – must stay within one mile of subject property, must stay within plus or minus 20% of the square footage of subject property; and finally, can only use comps closed within the past six months.

I find TWO comps that more than justify the sales price and they are exact matches – two bedrooms, one bath and a one-car garage. I turn those over to the Lender who turns them over to the Appraisal Reviewer.

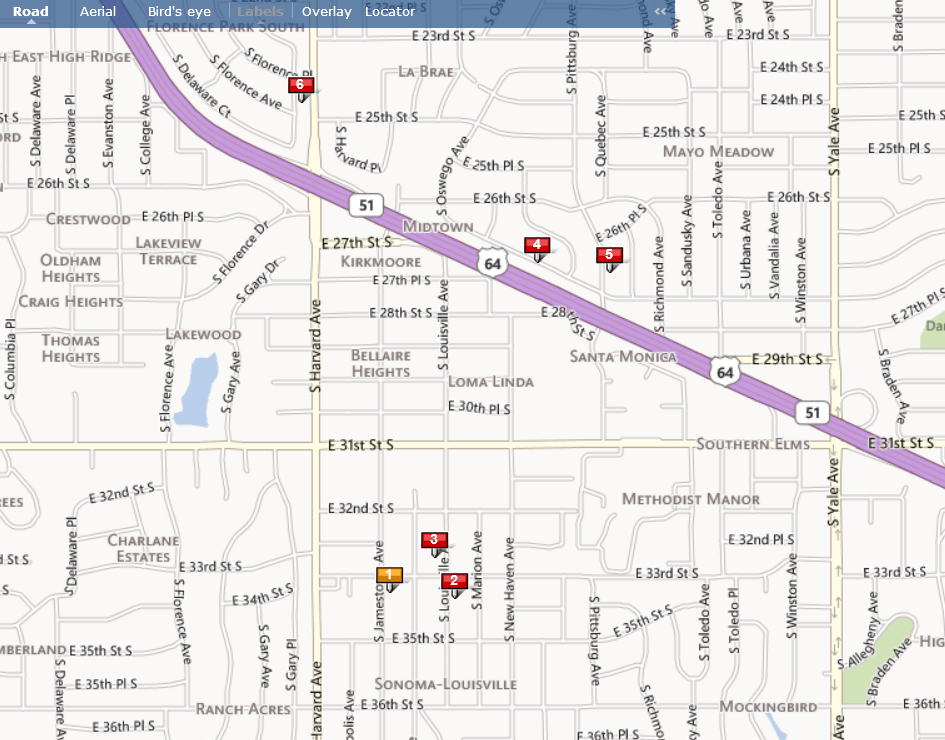

He doesn’t like my comps. He says we can’t cross Harvard (an arterial street) and we can’t go on the other side of the expressway. What the hell? Do I need to choose from properties only facing east?

In the image above, #1 is the subject property. Pins #5 and #6 represent the exact matches the Appraisal Reviewer will not consider.

Appraisals – it’s not just about comparables any more

I can pull comps around this house all day long that justify the sale price, but they’re all three bedroom. To have found TWO comps within a mile of the property that meet the guidelines and are EXACT matches – and then to have them turned down is ludicrous.

This was not a quick close. We have been under contract for 45 days, all repairs have been made and everyone is packed. I don’t object to an Appraisal Review process because I agree that there should be checks and balances. But to do this two days prior to closing when they’ve had the appraisal for two weeks? And then to add additional restrictions on top of the general guidelines???

As we go through real estate transactions, we check often to make sure things are on track.

Appraisal in okay? Check.

Survey in okay? Check.

Title work clear? Check.

Buyer out of Underwriting? Check.

Now I guess we need to add to that list:

Appraisal review okay?

I am also learning this evening that one red flag that initiated this review was that the appraisal square footage differed from that reported by the court house (public records).

One thing I will say about how we value properties as an industry – we just haven’t figured out a better way to do it. Our method of appraising properties does not take into account an open layout, a beautiful view or sensational details. We’re stuck on price per square foot because we haven’t determined how to quantify other mitigating values.

Can’t say how this transaction is going to end, but it’s not looking good this evening.

If you are searching for a Realtor to represent you who is involved in EVERY step of the process, please do give me a call! 918-852-5036

Content written and published by Lori Cain.