Perhaps the most confusing portion of the Oklahoma Real Estate Contract is how we deal with home repairs. AND, repair negotiations is when most contracts are apt to fall through.

UPDATE 2016: Changes in the Oklahoma Real Estate Contract – repair cap removed. All else works the same.

When a Buyer makes an offer on a home, he or she asks the Seller to be responsible for a dollar amount in repairs which we refer to as the “repair cap.” This number is an educated guess at best. Typically I get a feel for how well the home has been maintained, I consider the age of the heat and air, I check to see if the hot water heater is raised per code if in the garage, etc. But, it’s still a guess.

When a Buyer makes an offer on a home, he or she asks the Seller to be responsible for a dollar amount in repairs which we refer to as the “repair cap.” This number is an educated guess at best. Typically I get a feel for how well the home has been maintained, I consider the age of the heat and air, I check to see if the hot water heater is raised per code if in the garage, etc. But, it’s still a guess.

When we negotiate the contract, we agree on sales price, earnest money, closing date, home warranty, closing costs and all elements of the contract, including the repair cap. And we do this before the home Buyer has had an opportunity to perform inspections.

When the Listing Realtor presents a Buyer’s offer to his Seller, he must include the repair cap in the corresponding Net to Seller. If the Buyer has requested $2,000 to be spent in repairs, that amount must be included, even though we don’t know what that amount will actually be.

Once all terms are agreed upon and we have an executable contract, the Buyer has a time period (usually 10-12 days) in which to perform inspections. After inspections, the Buyer’s Realtor prepares a list of requested repairs and delivers to the Listing Realtor along with inspection reports. It is then the home Seller’s obligation to get bids for all requested repairs.

IF the amount of repairs is less than the agreed-upon repair cap, the Seller proceeds with repairs and the home Buyer does NOT receive a credit for any amount unused. So, if the repair cap is $2,000 and the repairs only came to $1,500, the Buyer does NOT receive a $500 credit.

On the other hand, if the repair bids come to $3,000 when the repair cap is $2,000, we must re-negotiate how that excess $1,000 will be handled. Sometimes the home Seller will just complete all requested repairs to promote a smooth transaction. Other times, the Seller will ask the Buyer to cross a few items off the repair list in order to stay under the repair cap. As you can imagine, these negotiations can become rather heated because the Seller does not want to spend more than agreed upon, and the Buyer wants to start fresh in a home with known defects eliminated.

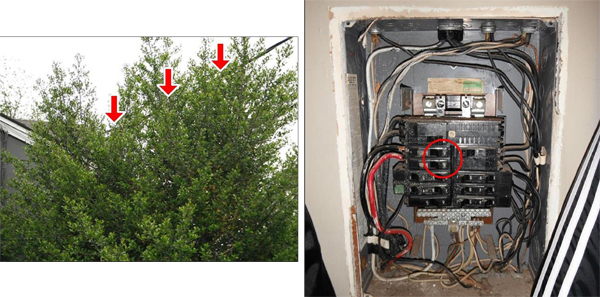

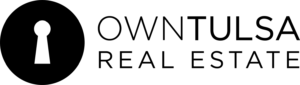

And if that’s not difficult enough, we may have to address Appraiser requirements. Particularly with FHA and VA financing, the Appraiser has the right to request that certain conditions are met. An Appraiser may request that a handrail be added to steps or he may request that peeling paint be scraped and new paint applied. Most Appraiser requirements will be related to areas of health and safety.

The difference between the repair items identified by the inspectors and the Appraisal requirements is that the Appraisal requirements are not negotiable. They MUST BE COMPLETED and approved by the Appraiser before this transaction can close.

There is much that can come up in inspections that no one could predict. There is water or moisture damage in the crawl space, there are structural concerns in the crawl space, or there may be evidence of live termites and no evidence of treatment. Like most home owners, I have never BEEN in my crawl space and have no intentions of ever doing so. And because my home has not been involved in a real estate transaction in 60 years, I can only imagine what repair surprises I would be faced with!

Home Repairs Negotiated in the Oklahoma Real Estate Contract

So when presented with an offer, a Seller understands and agrees to spend $2,000 on repairs. Then after the Buyer performs inspections, they discover that $5,000 worth of repairs needs to be done in the crawl space; and THEN the Appraiser turns in his report requesting an addition of a handrail and painting requirements. Suddenly that $2,000 repair cost has turned in to $6,500 which greatly affects the home Seller’s net – money which he may or may not have to spend.

As said earlier, Appraisal requirements MUST be completed and re-inspected prior to closing. Other repairs can be re-negotiated and taken care of after closing. Or many repairmen will complete repairs and wait to be paid at the time of closing. Sometimes the Buyer would prefer to select their own repairmen to make sure the work is done to their level of quality, and IF FINANCING WILL ALLOW, they may opt to take a credit for repairs, then complete work themselves once they own the home.

It is easy to see how real estate transactions fall through during this re-negotiation process. Sellers don’t want to spend more than originally agreed (and may not be able to afford it financially), and Buyers want to start fresh in a home as maintenance-free as possible. This is when very experienced and level-headed Realtors perform the ever-challenging juggling act of representing their clients’ best interest while promoting compromise.

At this point in the transaction, the Buyer has spent $500-$700 on inspections and another $400 on an appraisal. The Seller is boxing up personal items and has scheduled their move – they perhaps have a contract to purchase another home. Everyone is invested in a successful transaction, and it is in nobody’s best interest to let the repairs get the best of us!

I like to remind clients that a home inspection and the home inspector’s OPINION is but a snapshot in time. Recently I sold a home first day on market and our poor Buyer lost her job 5 days prior to closing. Because we had multiple offers, we were able to get back under contract with another interested party within the hour, and we were back on track. The INTERESTING aspect of this transaction was that inspections ON THE SAME HOUSE were done less than 20 days apart by different inspectors – and the results could not have been more different.

One would think that a hot water heater is working or not, but it is never that black and white. The first inspector pointed out that the hot water heater was 20 years old but reported that it was operating in normal working order. He also noted that he had seen this particular brand of heater last long beyond its life expectancy and he had no requirements. The 2nd inspector – 20 days later – could not get the pilot light to stay lit, detected some rust in the coils and recommend REPLACEMENT (not repair) of the entire unit due to its age. Obviously we can see opinions factoring in to the inspector’s recommendations.

On a different transaction, inspectors discovered evidence of live termites, electrical problems, roof problems and structural issues. My Buyer (who loved this home) asked me if she should proceed with the purchase. I smiled and responded, “you just had a hip replaced, a knee replaced and got dentures. Have they listed anything wrong with the house that can’t be fixed?” She proceeded with the purchase.

Whether you are a home Seller or a home Buyer, please be prepared to compromise and BE FAIR when it comes to home repairs. If it was your favorite home, has the perfect layout and is in the perfect location, let’s try to negotiate these repairs to something acceptable to you. And home Sellers, you may spend more on repairs than originally anticipated, but this is the price you will pay for not being more pro-active about home maintenance.

We don’t have to be adversaries – clients, nor Realtors. Let’s work together and come up with solutions to the challenges that home repairs can present.

This blog post is about home repairs as they are addressed in the Oklahoma real estate contract. Please note that repairs and many other aspects of a real estate contract differ from state to state!

If you would like a committed, full-time Realtor working on your behalf, whether you are buying or selling a home, please do give me a call! 918-852-5036

Content written and published by Lori Cain.